How to create an expense log step-by-step

According to Xero, around 50,000 SMEs fail every year due to cash flow challenges and one of the biggest factors that can affect cash flow is your business expenses.

Creating an expense log helps your small business keep its spending in check, which ultimately leads to a healthy cash flow and profitable growth in the long-term.

In this article, you’ll learn about expense logs and why they’re important. We’ll also walk you through seven steps to creating your own expense log.

As an added bonus, we’ve also included free expense log templates that you can download, customise and use for your business.

Table of contents

- What is an expense log and why do you need one?

- 7 steps to creating an expense log for your business

- 3 free expense log templates you can customise

- How a modern expenses solution can help to streamline your operations

- Wrapping up

What is an expense log and why do you need one?

An expense log is a record of all expenses your business has incurred during a certain time period. These expenses could have been incurred by a single employee, or a team working together on a particular project.

Regardless of the expense type, keeping an up-to-date expense log is essential for several different reasons.

Top Tip: Business expenses are usually divided into three categories; operating expenses, non-operating expenses, and capital expenses. Knowing the difference can help you effectively record, manage, and analyse your expenses. Learn more in our guide to how small businesses can manage expenses 🎈.

1. Prepare for tax time

HMRC allows you to claim some of your business expenses so they’re deducted from your income before it’s subject to VAT or any other tax.

These allowable business expenses include staff costs, office costs, travel costs, food expenses and some entertainment costs.

To be able to claim these expenses, however, you need to have an accurate and up-to-date record of all your business expenses for up to six years.

Maintaining an expense log helps reduce the total amount of tax you’re subject to pay by letting you claim your allowable business expenses.

Top Tip: Understanding what expenses your business is allowed to claim can help you save money and improve your cash flow. To dive into the specifics, read our detailed guide to what allowable expenses limited companies can claim 🎉.

2. Reimburse employees for business-related expenses

When you streamline expenses reporting, you’ll be able to properly reimburse your employees for any business-related expenses they might have incurred.

For example, they might have spent money on ordering coffee at a sales meeting, or during an out-of-station industry conference.

Reimbursing this amount will help them feel appreciated and taken care of, which will ultimately boost their morale and productivity.

Top Tip: Reimbursing business-related expenses falls under the umbrella of your company expense policy. If you don’t already have one, you run the risk of your team members potentially spending company money without realising if it is an acceptable expense or not. To avoid this, it’s best practice to create a detailed and transparent policy that outlines exactly what is expected of your employees when it comes to company funds. To learn more, read our guide to how to create a company expense policy 📖.

3. Reveal your employees’ spending patterns

Your employees might be spending more than they should on their business trips. The best way to catch such issues is to have them fill out an expense report every time they travel.

Regularly tracking and analysing expense logs can help you better understand the spending behaviour of your employees. Are they spending too much on entertainment? Is the cost of accommodation too high? How much are they spending on food?

Understanding spending patterns can help you make smart cost-saving decisions, such as specifying a hotel for their future stays or setting limits on food expenditure.

Top Tip: Business travel is a complicated operation to manage. You need to both set strict travel budgeting rules so as to avoid employee overspending while also leaving enough flexibility to allow them to carry out their job-related tasks effectively. To learn more about how to straddle this fragile line, read our guide to corporate travel management ✈️.

4. Stick to a budget

Once your employees start filling in expense reports, you’ll be able to get a clearer picture of your overall business expenses.

This will help you analyse whether you’re staying inside your business budget plan or exceeding it. It will also prevent employees from potentially stealing from your business as they’ll need to log every single penny they spend.

7 steps to creating an expense log for your business

Now that you know what an expense log is and why it matters, let’s take a look at how you can create one for your own business.

Step 1: Address the basics

The first section of your expense log should include basic information about the employee.

This is helpful for identifying the exact employee who is responsible for the listed expenses and needs to be reimbursed.

The fields you include in this section will vary depending on your business type. Generally, most businesses include the following information:

- Employee name. The easiest way to identify the employee reporting the expenses is with their full name.

- Employee ID. There might be more than one employee with the same name. To avoid any confusion, it’s a good idea to ask for their unique Employee ID number.

- Department. You may also want to ask for the department the employee works for. This information is not only useful for quickly reaching the employee for any questions but also to track expenditure by department.

Other information you may ask for in this section could be the employee’s contact number, their manager’s name, the payment period and the place where they incurred those expenses.

Step 2: List your expenses

Next on your expense log should be a dedicated section where employees can list their expenses one by one.

This section will likely take up the most space which is why we will continuously address it up until the end of step 5.

A good expense log should be easy to fill out and not feel like a tiresome chore. Ideally, you should create a table with different columns, one of which should record the various expenses your employee incurred during an event or trip.

Reading expenses from a list will also make it easier for you to approve them. All you need to do is verify the listed description and amount with the attached receipt. More on this later.

Step 3: Record the expense dates

The most common clarifications required by accounting departments are related to the exact date the expenses were incurred.

Your accountant shouldn’t have to chase after different employees to get clarification over expense logs. Not only would this take up a lot of time and effort, but it would also defeat the purpose of having an expense log in the first place.

To avoid the hassle, you should have a dedicated column in your expense table that records the exact date of each expense.

For employees, it’s easier to input the date as soon as they incur an expense. Later on, they’re more likely to forget the date or even lose the receipt as proof.

You can also choose to mention the day of the week instead of the date. However, most businesses prefer using dates as some work trips may take longer than a week, and sorting through the days can get confusing.

Step 4: Categorise expenses

Categorising your expenses can help make it easier to track and identify each expense and why it was incurred.

This can help you gain better insight into the spending habits of your employees, and can also make it more convenient to zoom in and track expenses related to a specific category.

You can categorise expenses inside your expense log by creating columns for each category. Here are some common expenses categories to consider adding:

- Air travel

- Hotel expenses

- Car and fuel

- Meals

- Utility expenses

- Entertainment expenses

This way, your accountant will be able to give you an accurate picture of which category employees are spending the most in, such as hotels and lodging or daily meals.

It’s important to note that some business owners feel that categorisation may end up complicating the form and confusing the employees.

If you feel that a brief description of an expense is enough for your business and its employees, it’s best to go with what you feel comfortable with.

Step 5: Add up the total expenditure

At the end of your main expense log section, you should add a space where employees can mention the total amount they have spent and thus need to be reimbursed for.

Even though your accountant will likely go through each expense one by one, mentioning the total amount makes it easier for everyone to get the big picture straight away.

Your small business may choose to give some amount of cash in advance to employees for their expected expenses.

In that case, it’s a good idea to have a section that records any cash received in advance. This will make it easier to deduct that amount from the total expenses and reimburse only the difference to the employee.

Step 6: Attach relevant receipts

Once you’ve taken care of the main body of your expense log, make sure you add a sentence somewhere that reminds employees they need to attach receipts to back up their expenses.

Handling and tracking physical paper receipts and bills may be a frustrating task for your employees, which is why it’s important you guide them through this.

One smart way to handle receipts is to take a picture of each bill as soon as an employee receives it and save a digital copy to print later in case the physical copy gets lost.

Step 7: Leave space for signatures

The last section of your expense log should be dedicated to approvals and signatures.

This section is usually at the bottom of the form, and looks something like this:

Typically, an expense log needs to be approved by the immediate manager of the employee, as well as the accounting department.

This is because managers should be aware of the spending habits of their employees. They also act as the point of contact for the accounting department in case an issue arises.

Once your employee fills in an expense log, they’ll hand it over to their manager to sign and pass it on to the accounting department, who will then be responsible for record-keeping and reimbursement.

Some businesses also choose to add a space labelled “For Office Use Only” to specify that only the accounting department can sign or stamp here.

Free expense log templates you can customise

You can choose to create an expense log for your own company from scratch. But if that sounds too time-consuming, there are several templates of spreadsheets available online that you can use instead.

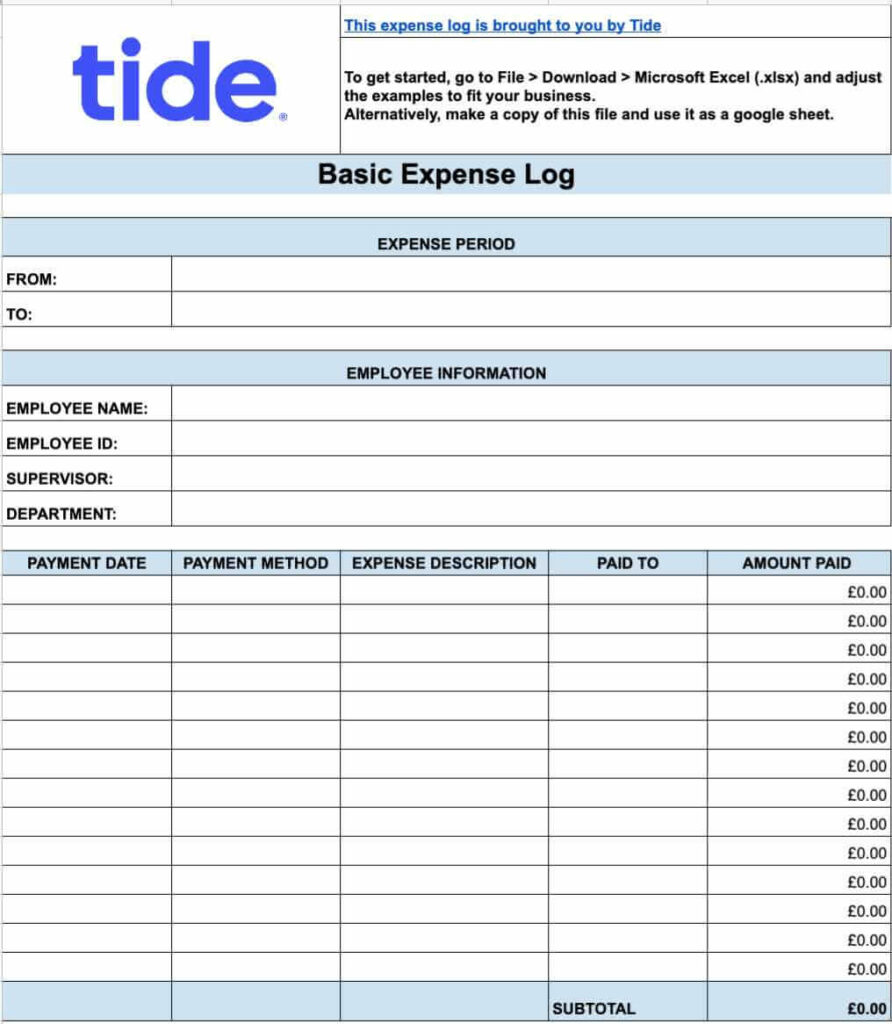

To make things easier for you, we have created some user friendly templates for you which you can access, make a copy of and customise for free.

Once you open the template, you’ll notice that there are two tabs: basic and travel.

The “basic” tab is great if you want to keep things simple and don’t want or need to categorise any of your expenses. This template is ideal for small businesses who are just starting out and want to streamline their expense management process. It’s also great for distinguishing between expenses paid by an employee out of his or her own pocket and those paid with company funds.

The “travel” tab is more detailed and is ideal for deep diving into the specific travel expenses an employee incurred on a trip. This way, you can understand where and how much money employees are spending money on business trips and use that data to optimise your travel budget.

How a modern expenses solution can help to streamline your operations

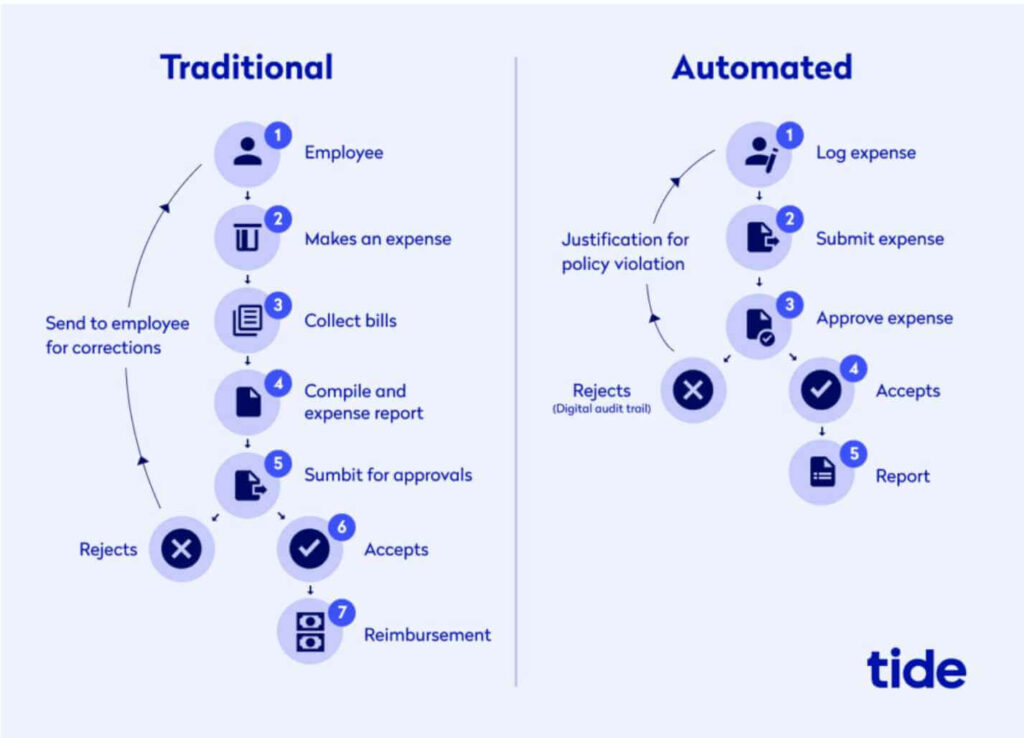

While manual expense logs make sense for small businesses with few employees, they become increasingly difficult to manage as your business and team grow.

An automated expense management system streamlines the expense tracking process in the following ways:

- No paperwork: Say goodbye to holding onto paper receipts. With a modern expense solution, you can simply scan or take a picture of your paper receipt and upload it directly into your online system. Then, manually match the receipt to the already logged transaction and you’re all set.

- Accurate data entry: Because you’re not recording transactions by hand, not only do you save time, but you significantly reduce the risk of making an error.

- Insightful reports: Everything is automatically saved online, so if you want to quickly get an overview of your employees’ spending, either in real-time or after the fact, you can sort by employee name, transaction type, expense categories and whether VAT was paid with a few simple clicks.

- Integrates with accounting software: Many expense solutions integrate with accounting software so that your accountants can easily gain access to your expense logs and reports. This saves you valuable time spent going back and forth with accountants and helps to streamline your entire operation.

As you can see, an automated system removes half of the steps required when submitting an expense report. There’s no need to compile an expense report as everything is already logged, recorded and categorised in the system. This significantly speeds up the entire process and frees your team up to focus their energy on the primary tasks they were hired for.

Tide’s company expenses feature helps you to do expenses the smart way. You can order expense cards for your team and set limits so that your employees know exactly how much they can spend and on what. After the expense, they simply take a picture of the receipt, upload it and get back to work.

Top Tip: Do expenses the smart way with Tide Expense Cards. Your team can pop their expenses straight on their own company expense cards. It saves them paying out of their own pocket, and saves you processing their expenses. Plus, you can attach receipts directly in the app, and more. Get started today – open a free business bank account and order company expense cards for your team 🎉.

Wrapping up

Creating an expense log for your small business is the first step to effectively managing your company’s business expenses and improving cash flow.

An expense log will help you prepare for tax time, stick to a budget, understand the spending behaviour of your employees and reimburse them properly to improve their morale.

To create an expense log, you can either choose to start from scratch or use a template to save time. Make sure you customise it for your own business so your employees feel comfortable filling it out.

Photo by Kampus Production, published on Pexels